Ex Gratia Payment In Malaysia

Q a session 3 4.

Ex gratia payment in malaysia. The lump sum payment may be described by the employer as compensation for loss of employment ex gratia contractual payment retrenchment payments or gratuity etc. They are payments for services and are therefore taxable. The amount paid on the termination of an. 5 3 the circumstances and nature of the payment must be reviewed to.

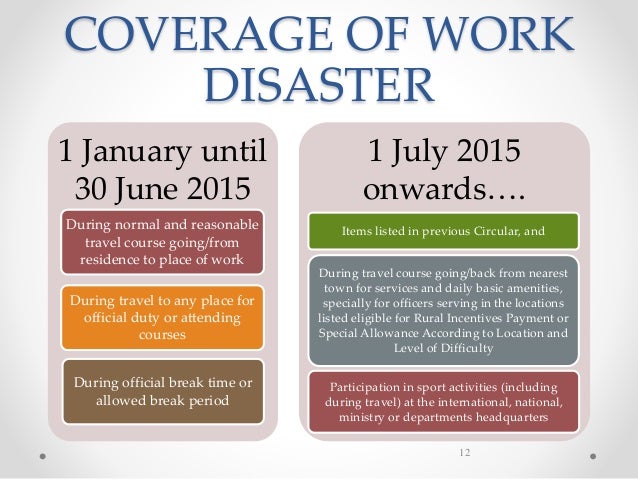

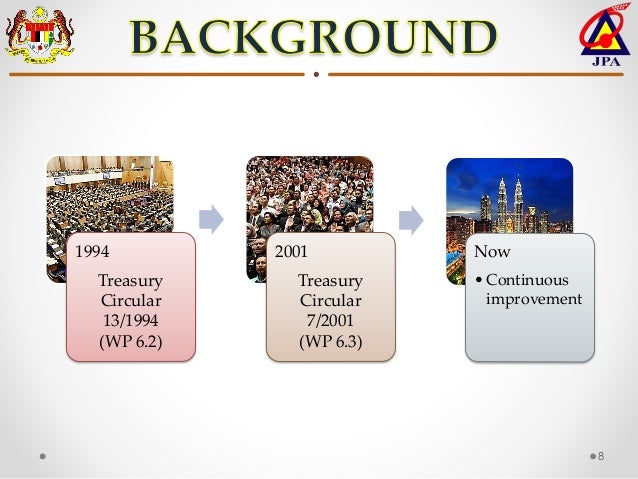

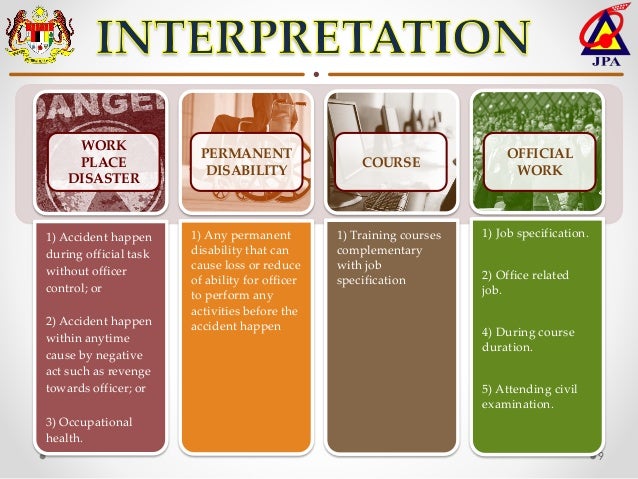

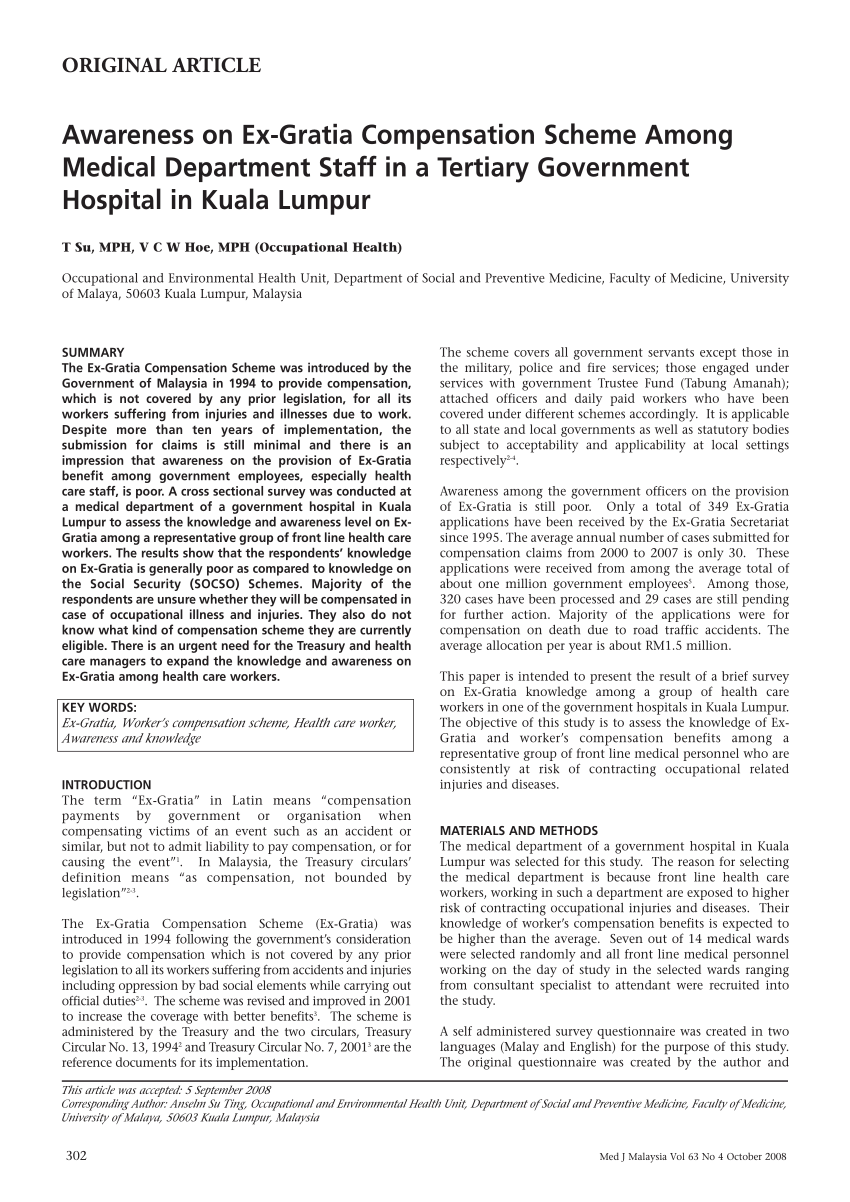

According to the inland revenue board malaysia lhdn when an employment ceases the employer may make a lump sum payment to the employee. The ex gratia compensation scheme was introduced by the government of malaysia in 1994 to provide compensation which is not covered by any prior legislation for all its. 4 3 the circumstances and nature of the payment must be reviewed to determine the real character of the payment. Payments which are made to volunteers do not attract the operation of the epf act for the obvious reason that volunteers are not employees.

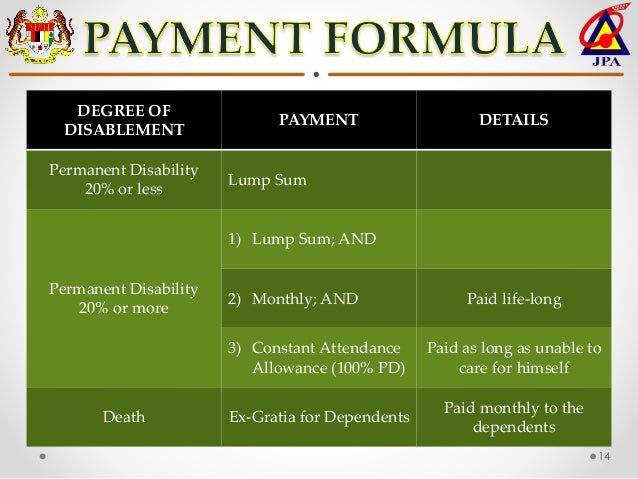

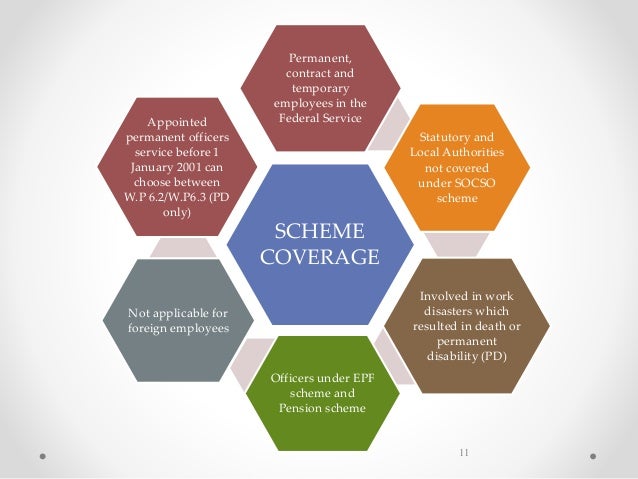

Formula and conditions of payment 4. Key features on the available for workers in malaysia 2. In 2016 the new zealand government awarded david bain an. Lump sum payment may be described by the employer as compensation for loss of employment ex gratia contractual payment retrenchment payments gratuity etc.

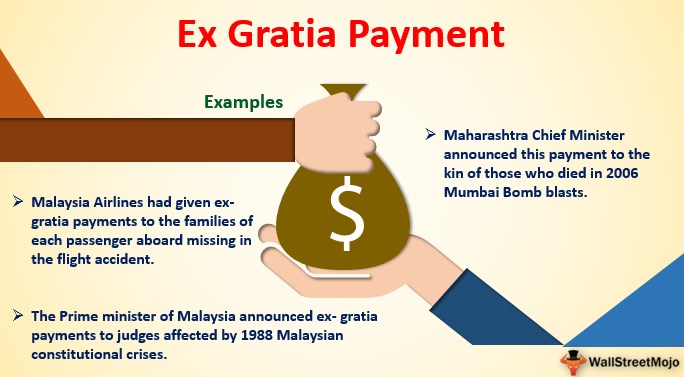

Payment in its true nature and character was ex gratia that is to say totally voluntary and was not compensation which implies some sort of an obligation to pay. Disability management initiatives 5. The type of outplacement support may vary from one company to another. An ex gratia payment is made to an individual by an organization government or insurer for damages or claims but it does not require the admittance of liability by the party making the payment.

Malaysia airlines offered an ex gratia condolence payment of us 50 000 to the families of each passenger aboard the missing assumed crashed flight mh370 but those affected have considered the conditions unacceptable and have asked the airline to review them. Ex gratia in malaysia 1. The lump sum payment may be described by the employer as compensation for loss of employment ex gratia contractual payment retrenchment payments gratuity etc. However other payments such as salary in lieu of notice ex gratia and gratuity for past services are not payments for loss of office.

Payment in accordance with the terms and conditions of the contract of service. 2 wan nur insyirah binti wan ramzan kgj 150040 nor illiani binti ramzi kgj 150050 marina binti muhamad kqd 160022 3.