Goods And Services Tax Act And Its Impact On Gdp Project Class 12

As per the central goods and services tax act 2016.

Goods and services tax act and its impact on gdp project class 12. Gst is a comprehensive tax levy on manufacture sale and consumption of goods and services at a national level. To know about the impact of india s goods and services tax gst on its economy. The same will reduce the cost of the transaction. Gst positive impact of gdp.

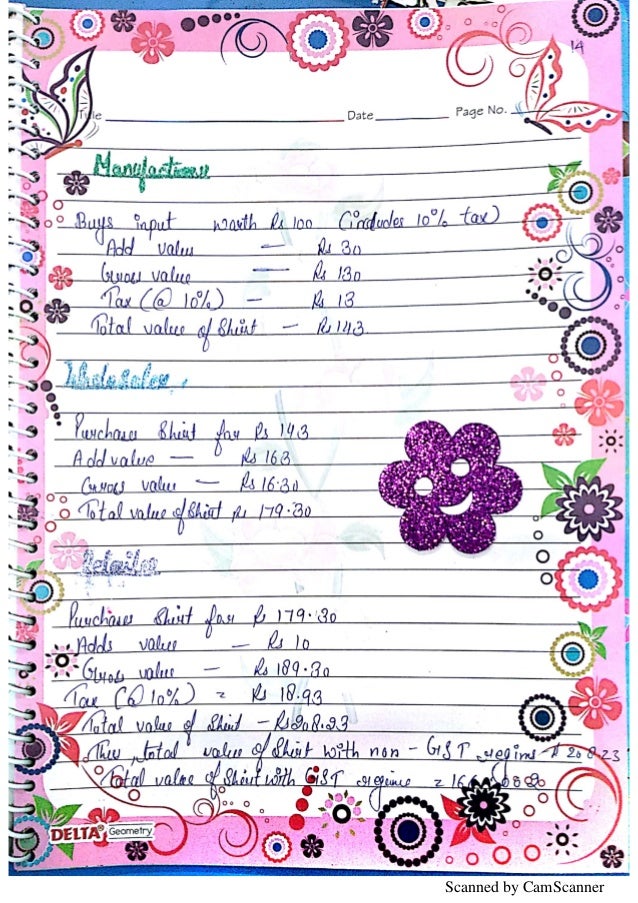

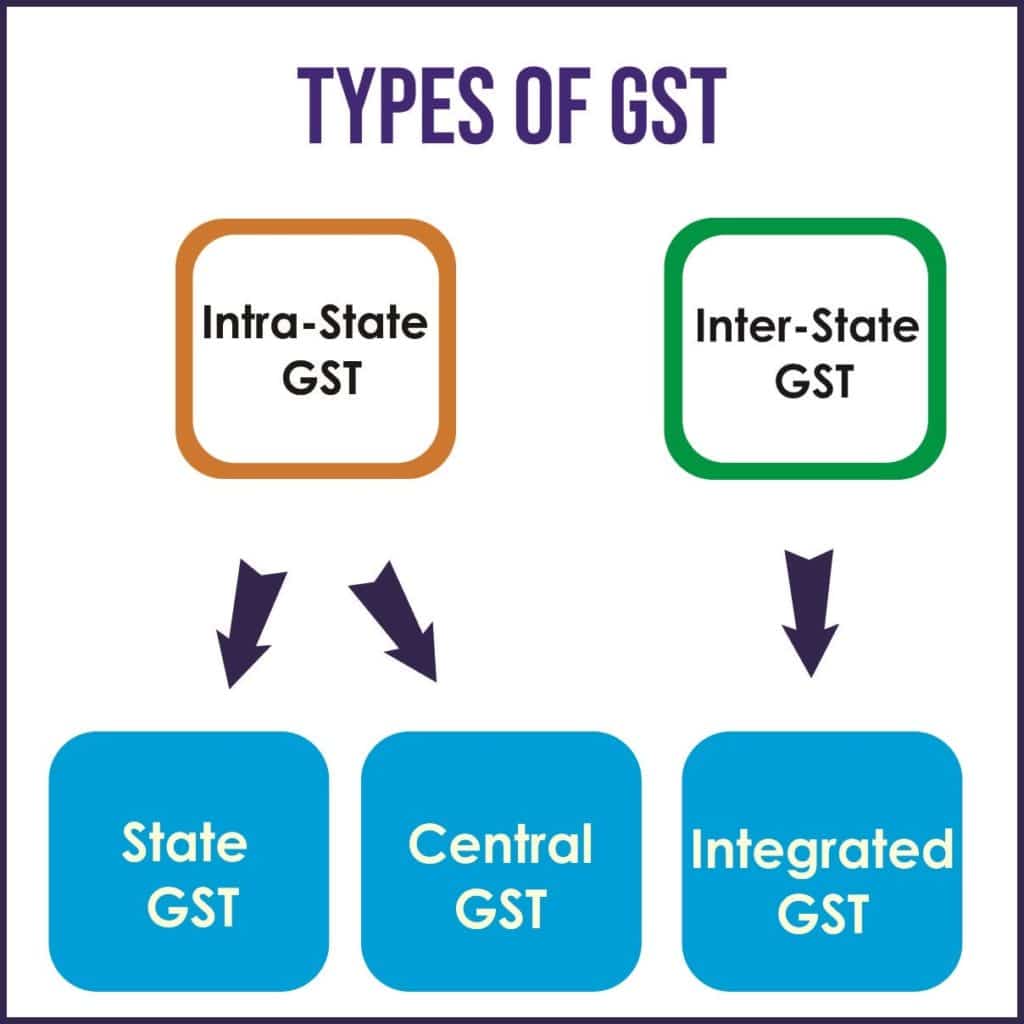

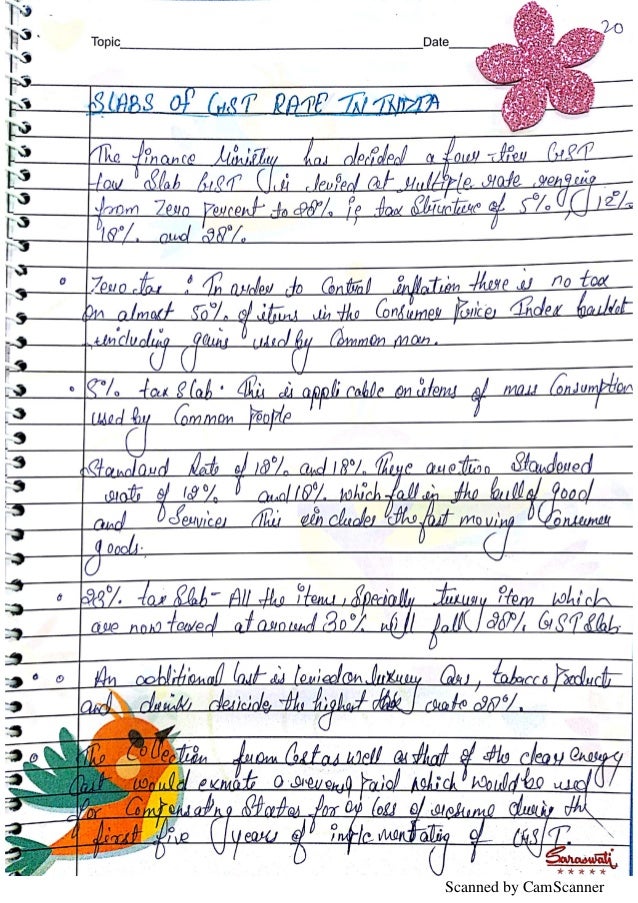

It is found that 43 of 1211 items have put in 18 gst slab which is bound to make things cheaper 14 items have been brought under 5 gst slabs 17 items in 12 tax slab and rest only 7 have been exempted from gst ambit. Gst is a part of proposed tax reforms in india having an extensive base that instigate the applicability of an efficient and harmonized consumption tax system. However petroleum products alcoholic drinks and electricity are not taxed under gst and instead are taxed separately by the individual state governments as per the previous tax system. Tax slabs are decided as 0 5 12 18 28 along with categories of exempted and zero rated goods for different types of goods and services.

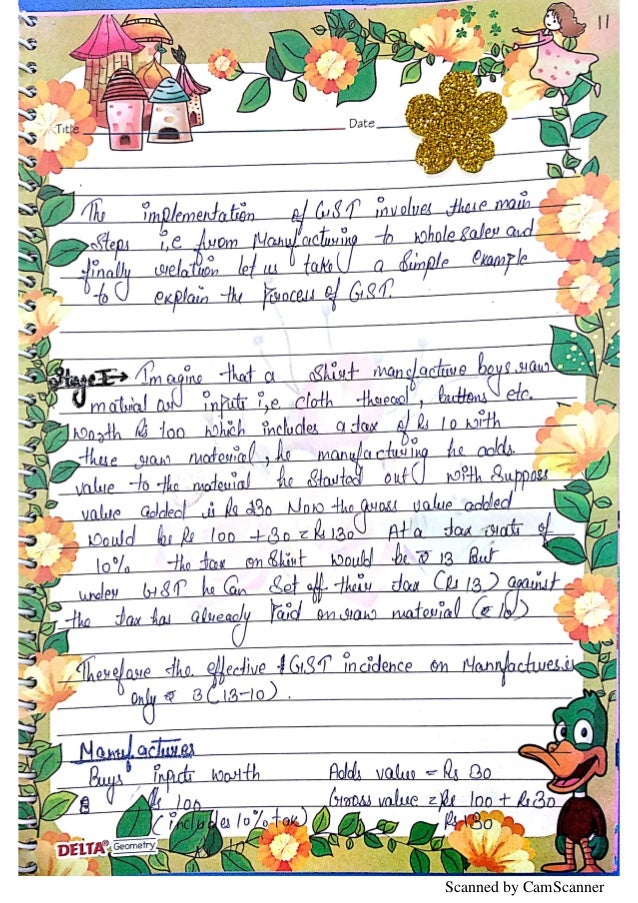

Gst is a comprehensive indirect tax levy on manufacture sale and consumption of goods as well as services at the national level. Now there is only one tax rate for all which will create a unified market in terms of tax implementation and the transaction of goods and services will be seamless across the states. It will replace all indirect taxes levied on goods and services by states and central. There are around 160 countries in the world that have gst in place.

Goods and services tax is set to be rolled out from 1st july 2017 and gst council in its meet in srinagar on 18th may 2017 decided on tax rates or 1211 items. Goods and services are divided into five different tax slabs for collection of tax 0 5 12 18 and 28. Previous psychology project class 12 schizophrenia. Next marketing management of energy drink business studies project.

To order projects on any topic and subject contact us at 91 8860013924 click on the link below to whatsapp.